Measure E’s Approval Would Keep One Funding Stream Stable For Now , But District Will Still Face Significant Budget Challenges

By Larry Freeman

Polls open at 7 a,m. and close at 8 p.m. Alameda City has six polling places open: for locations , visit https://www.acgov.org/rov_app/vcalist or search “Alameda County Vote Centers”

—————–

Voters around the state will take to the polls tomorrow, Tuesday, March 5th to weigh in on a number of matters, some to select from variety of Primary Election candidate, with votes that elect no one at this time, and some with votes that carry very real, here and now consequences.

AUSD’s proposed parcel tax renewal proposal, Measure E, is one of those high stakes, determinative matters in this election, and its passage or failure will result in significant positive or negative impacts on Alameda’s school district, its students and the community at large.

Some of those effects include maintaining, reducing or eliminating programs related to art and music, maintaining or reducing Advanced Placement class offerings, teacher salary, maintaining or reducing library services and more.

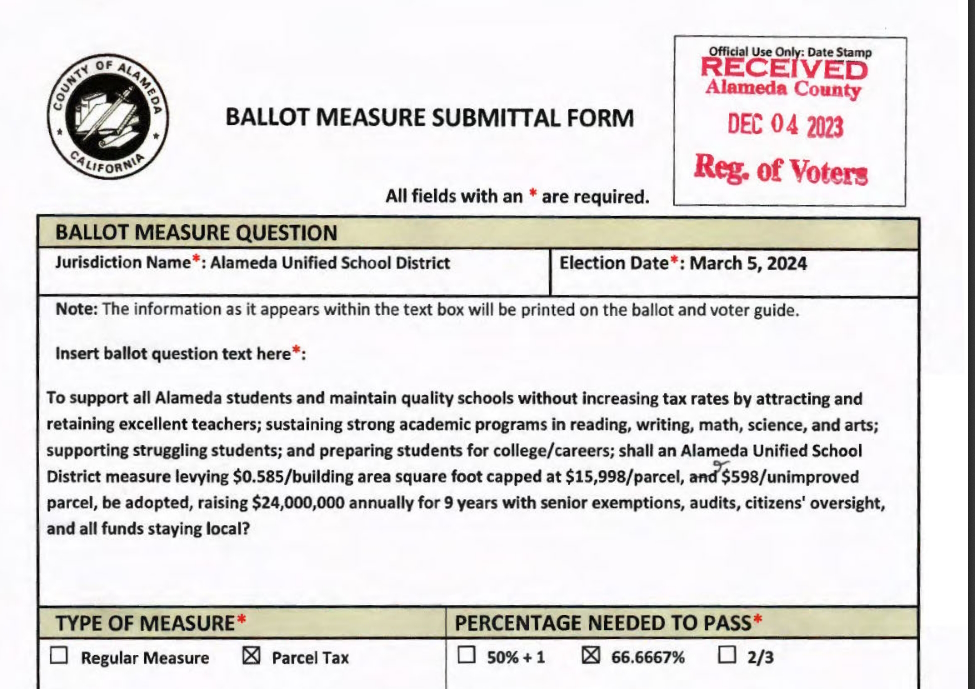

Measure E, if it passes with the super majority 66.7% of the vote needed under state law, would keep current AUSD school parcel tax rates unchanged , and combine two previous tax measures, Measure B-1 and Measure A, to continue local school funding as is.

A looming, short-term issue with AUSD’s bottom line is B-1, which brings in about $12 million per year, and expires in 2025.

If Measure E fails, the district will take a hit of just under 13% of its total annual budget of about $ 153 million for the current fiscal year.

Measure A, set to expire in 2027, would pose another financial blow to the district if E goes down and another tax is not proposed along the way. E brings in around $ 11 million which is dedicated to teacher compensation.

Even if Measure E passes, the district will still face a budget deficit environment in the near term, a substantial matter to be explored in a story to come later.

With the two existing taxes comprising about 20% of the budget, E’s rejection would “be devastating, a tremendous blow” to the district’s coffers, programs and quality of education according to Steve Kellner, a member of the Parcel Tax Program Oversight Committee, an independent entity required by law to scrutinize how the district spends parcel tax dollars and report any matters of concern to the district and public.

Kellner, AUSD and members of the “Yes On E” campaign, which has sent out a number of mailers to Alameda residences and canvassed door to door, all agree that things will take a turn for the worse in Alameda’s schools if E does not cross the vote threshold.

Class sizes would be almost certain to grow, along with program cuts to reduce the number of teachers on board at a school. That scenario usually results in teacher layoffs of cuts to part time if attrition through such elements as retirement do not offset the staffing cuts.

Class sizes, with the two taxes still in effect, are 25:1 for K-3, 32:1 for 4th through 5th grades, 32:1 for 6-8th and 35:1 for high school.

“Library services and fine arts would be reduced or eliminated, Advanced Placement Classes which are funded by this initiative (B-1) would be reduced or eliminated, so it would be fairly drastic,” said Kellner.

“These dollars supplement state funding and are exclusively for AUSD to fund programs the community has come to expect. Advanced classes and library services are all paid for by the parcel tax.

California ranks around 40th in the nation measured by per pupil funding and Governor Newsome’s current budget proposal has no Cost Of Living adjustment for Alameda Schools even as inflation for another range of district costs takes a toll.

Parcel Tax dollars “also help provide a ‘competitive wage’ so that AUSD is on par with other Alameda County Districts. Not above or below, but on par so that our teachers have a fair compensation.,” Kellner said.

Measure A’s teacher pay component also provides for what Kellner says “reduces the churn,” a staffing issue that occurs when AUSD takes on new hires only to have them leave after a year or two in search of better compensation elsewhere.

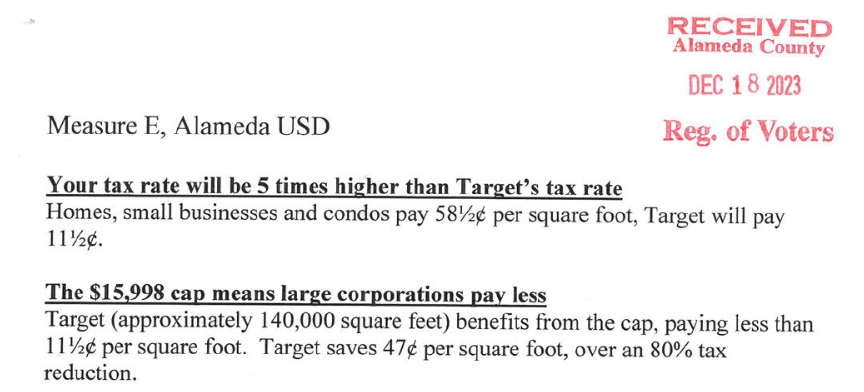

Not even the “No On E” proponents, headed by two locals, deny that, nor do they allege that funds are not being properly or effectively spent. Rather, the two signators who registered with the Alameda County Registrar’s Office to oppose E claim that the tax is ethically “inequitable” as it does not use a flat tax construction, but rather charges a flat tax rate of about 58.5 cents per square foot of building size, whether residential or commercial.

Marcus Crawley an Alameda resident and President of the Alameda County Taxpayer’s Association and Leland Traiman, who originally brought suit against Measures B-1 and A, claim that E does not conform to principles of tax “uniformity” and urge a no vote claiming that it is a “corporate tax giveaway or a corporate big tax break.”

“If you think (a non uniform application of the tax) is fair, you should vote yes. If you think this is unfair and want an equitable tax measure in November (when they would like the tax measure to be placed instead of now) vote No on E,” they wrote in their filing.

Commercial rates are capped at $15,999 on commercial properties which is the basis for the anti-tax group’s inequity claim. Two different California Appeals Court rulings have rejected those claims as a matter of law, leaving them only with their ideological stance.

(The ‘Yes On E’ campaign, “Alameda Forward” counters: “Measure E ensures that large property owners pay their fair share. Single-family homeowners and small business owners pay less than big businesses.” Levitt compared it to the difference between how income tax rates are set for those who earn more or less vs. flat taxes as those at the gasoline pump or cash register.)

Tied to bringing in a winning vote is voter turnout and, since Measure E is on a Primary Election ballot, as the district did not want to wait until November, past the deadline to submit their 3 year projected budget to the state in June.

Kellner is well aware that Primary elections as this often result in lower voter turnout, and he offered some perspectives in his separate role as a resident and member of the “Yes On E” campaign.

The “Yes On E” campaign’s members are directed to contact about 150 residents and Levitt noted that while almost all of his contacts were receptive to supporting E, “they were often not aware it was on the ballot.”

“They may not be as interested in the election as a whole as it is not a Senate or Presidential Election. This is a primary race for candidates, but not for Measure E,” said Kellner.

He stated, for the record, that his two different involvements did not pose a conflict of interest. “If I thought that the tax dollars were not being well spent,” he said, “I would not be a volunteer.”

Kellner indicated that the ‘Yes On E’ campaign knows who voted in favor of prior measures in last elections so, “if we turn those voters out, the measure will pass. We do feel the demographics are there.

We are working hard to make sure they don’t sit this one out.” he added. “We just need to make sure they get those ballots in.”